Contents

The secret unbundled vc master plan (just between you and me) - newsletter exclusive

Hidden taxes in venture capital

Some events and a podcast

Investments and investment commitments

Portfolio company news

Interesting articles

Anything else

The secret unbundled vc master plan (just between you and me)

unbundled vc invests its own money in early-stage businesses. Despite building in public, I haven’t been public about its master plan. Here it is.

1. Build incredible deal flow

Why?

unbundled vc can’t invest well without great deal flow. It can only choose from the things in front of it. It needs to see as many of the great businesses as possible to choose from.

As importantly, when a deal is competitive, it needs founders to choose it. So far it’s been in four competitive deals and got into all of them.

How?

Treat people right. It’s the right thing to do. It’s not difficult. Founders talk to each other. If they don’t say nice things about unbundled vc, it won’t get great deal flow and it won’t get into competitive rounds. Shout out to Landscape and their anonymous founders slack channel. Founders, if you’re not on there you need to be.

Build in Public (see below).

2. Invest exceptionally

Why?

This ought to be obvious. unbundled vc invests my own money. It’s money I’ve been fortunate to generate over the course of my career. I am risking it on investing in venture. I have to get this right.

How?

Know my criteria. Invest intentionally by using the process that most accurately and quickly enables me to figure out if a business meets those criteria. Back my judgment. Don’t worry about what others will think. I’m either good at this or I’m not and there’s no point pretending.

3. Build in public

Why?

To generate deal flow. To generate future investors in a fund. To help founders.

How?

Build a community of founders who can see how unbundled vc operates. Build a community of future investors who can see how it operates.

How?

Be as public as I can be on socials. Be as open and honest as I can be about what I believe and how unbundled vc operates.

Founders remember unbundled vc exists. Founders talk to one another. If it treats them right and they know how unbundled vc operates and they remember it exists, it will generate great deal flow.

Other investors remember unbundled vc exists. Other investors can see what unbundled vc believes and how it operates. They share deals. They ask about unbundled vc’s existing investments.

Potential fund investors know unbundled vc exists. They can see what it believes and how it operates and the businesses it invests in and why it invested. If I raise a fund they will already know me and how unbundled vc operates before they meet me.

I’ve already had inbound from people I had no idea were reading my posts who said if unbundled vc ever raises a fund they are in.

4. Raise a fund

How?

Build incredible deal flow. Invest exceptionally from that deal flow. Build in public.

Why?

Help founders more by putting more capital to work. Generate better deal flow because founders know you have more capital. Invest better because of that deal flow. Make money for my family by investing exceptionally. Repeat.

Keep doing 1, 2 & 3 because they are the things that got me here and are the right way to invest.

So, in short, the master plan is:

Build incredible deal flow to choose from

Invest exceptionally from that deal flow by investing intentionally

Build in public to enable 1 & 2 and to generate future fund investors

Raise a fund

Don’t tell anyone.

2. Hidden taxes in venture capital

3. Some events and a podcast

I did a podcast with Nzube Ufodike’s Crown Caste.

I was at Sifted Summit.

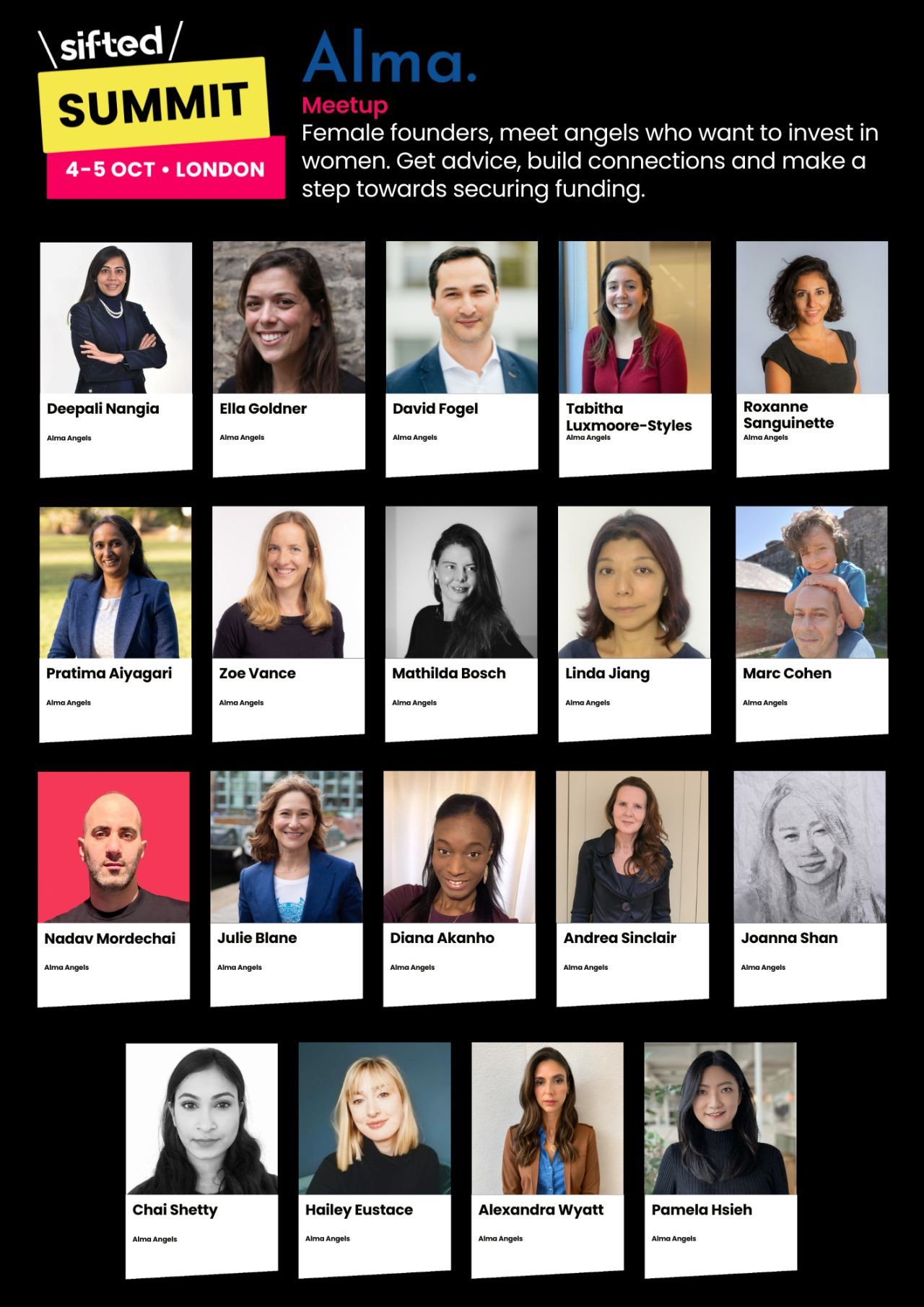

I did female founder office hours for Alma Angels at Sifted Summit.

I was an ambassador for and part of a fireside chat for Locate Guernsey’s Relocate to Guernsey Show.

I was a judge for the Guernsey Venture Challenge which awarded £70,000 of prize money.

4. Investments and investment commitments

No new investment commitments.

2 new investments, both closed, both not yet public.

3 follow-on commitments, not closed, not yet public.

1 new investment with a round that is not public.

1 follow-on investment with a round that is not public.

5. Top posts on LinkedIn and Twitter

Twitter - I’m fortunate to live in Guernsey

Bonus - #TodayAtSiftedISpokeWith a lot of people

6. Portfolio company news

Magrathea aims to make metals with mining by extracting magnesium from seawater.

YASO and Duel are hosting the Beauty Growth Summit.

Playter’s Jamie Beaumont is one of the 40 Under 40.

Chantal Epp of ClicknClear talks about being a founder with a young baby.

Jonny Rosenblatt of Spacemade talks ❗ BIG BOY SH*T ❗.

7. Interesting articles

China troubles could upset Apple’s cart as it prepares to launch the iPhone 15

Exercise Induced Hormone May Be Key Player in Alzheimer’s Fight

‘Like a dream’: successful return of Nasa capsule with asteroid sample hailed

8. Anything else

That’s all folks.